The Clean Energy Finance Corporation finalised more transactions in the last financial year than it did in its first three years of operation, according to the just-released 2016-17 annual report.

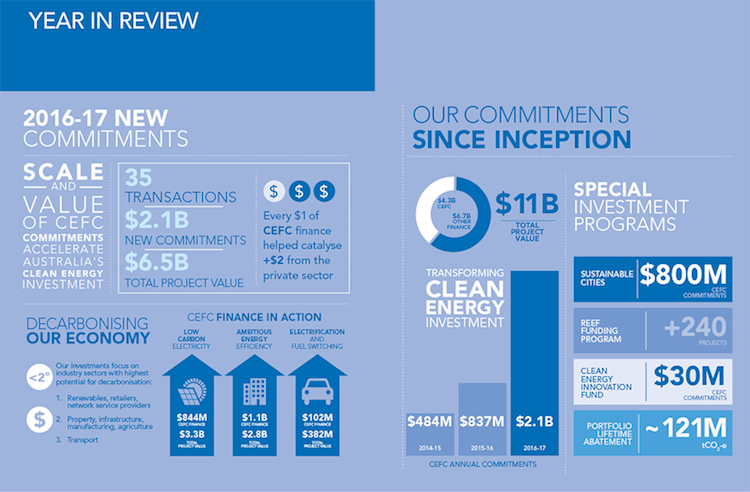

More than $2 billion was invested in projects worth $6.5 billion, meaning $2.10 in private investment was leveraged for each $1 invested by the CEFC. Current investments are in line to reduce CO2 by 7.3 million tonnes a year, or over 121 million tonnes a year over project lifetimes.

“The accelerated pace of CEFC commitments in the 2016-17 financial year was the result of significant origination, marketing, research and stakeholder engagement activities across targeted industry sectors,” the report said.

“It also reflected an improved policy environment, greater awareness of the importance of clean energy investment, and increased investor confidence.”

All up the CEFC’s $3.4 billion portfolio of investments has a forecast investment yield of over five per cent – cutting carbon emissions at a profit.

This year’s return rate was 4.65 per cent, though this was lower than the government’s expected portfolio benchmark return (PBR) of between 5.74-6.74 per cent. The portfolio return is at 4.65 per cent against a target of 5.95 per cent.

“While the improvement in the actual rate achieved was positive, the board has previously advised that the PBR target is considered high, given the CEFC’s narrow investment universe, risk profile and public policy purpose,” the report said. “Every transaction entered into by the CEFC (even after providing for concessionality) is at a rate of return that exceeds the five-year government bond rate.”

Chair Steven Skala said the organisation had delivered strong performance and achieved new highs in 2016-17.

“The CEFC was created with a clear charter to stimulate change in Australia’s investment in clean energy, as a key pathway to the decarbonisation of the Australian economy,” Mr Skala said.

“CEFC investments are delivering positive returns to taxpayers, while catalysing or leading to additional private sector finance in the sector and helping reduce Australia’s emissions.”

More than half of new funds were put into energy efficiency, with $800 million going to the new Sustainable Cities Investment Program, which now has projects with a value of $1.8 billion, and a lifetime abatement potential of 17 million tonnes of CO2.

“The Sustainable Cities program leverages private sector capital to accelerate the deployment of cutting edge clean energy projects in Australia’s cities,” the report said. “These can include precinct-scale renewable energy plants and installations, next generation transport management systems, ‘green’ buildings and energy efficiency retrofits for social and affordable housing.”

CEFC chief executive Ian Learmonth said the CEFC had a clear investment focus and a substantial, growing portfolio, and would begin looking at new areas of investment.

“Distributed energy, energy storage, improved grid transmission, network security and demand response management are all areas that require greater investment,” he said.

“They also have a central role to play in reducing carbon emissions, by ensuring the benefits of cleaner generation are delivered across the economy, alongside a much stronger focus on reduced energy consumption.”

- Read the CEFC annual report for 2016/17