The term granny flat—a name that, while widely recognised, doesn’t quite capture the potential of these units. A better term is Ancillary Dwelling Unit (ADU) because these dwellings aren’t just for grandparents; they’re a versatile housing option for anyone.

Spinifex is an opinion column. If you would like to contribute, contact us to ask for a detailed brief.

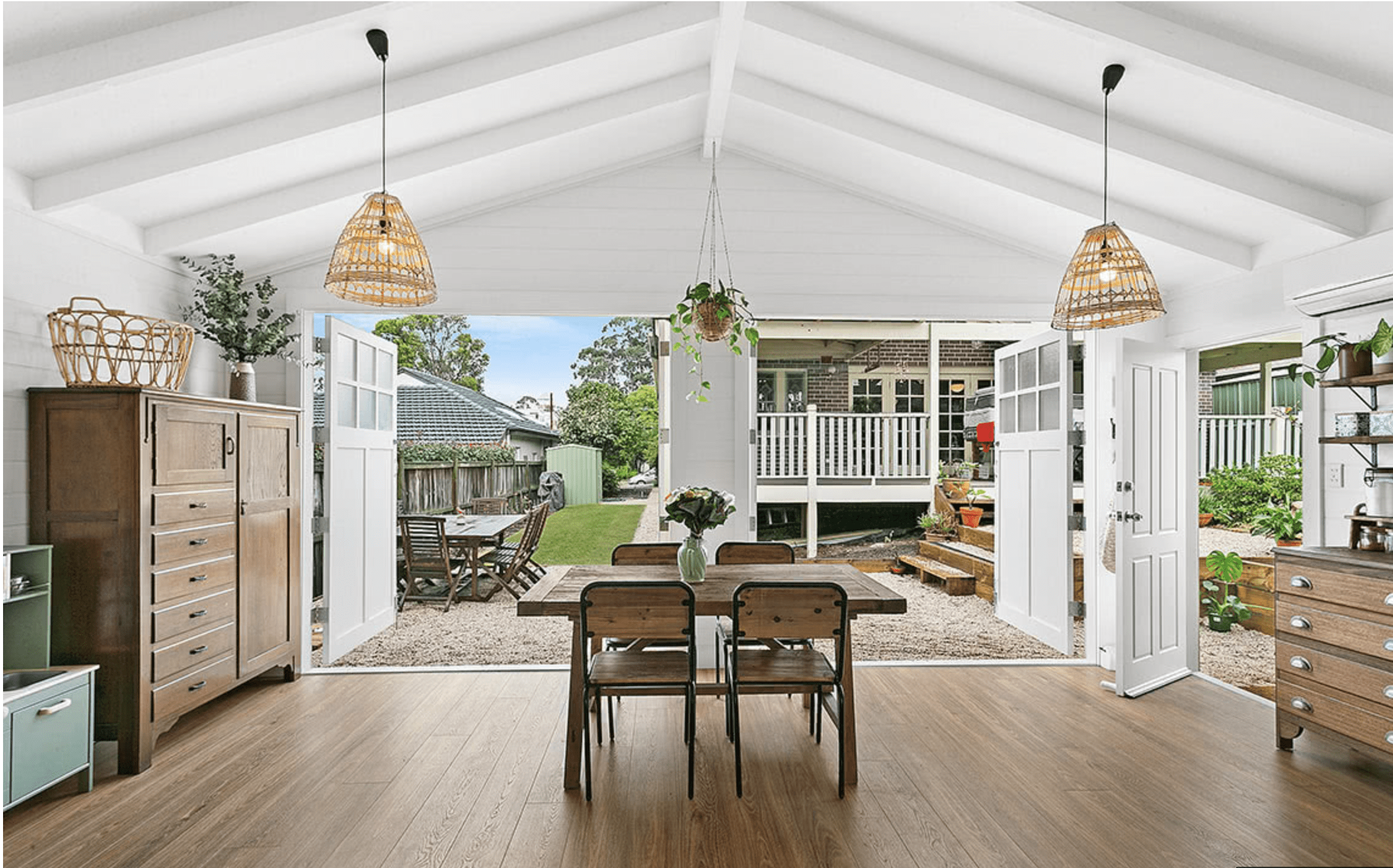

In late 2023, Victoria joined New South Wales in allowing homeowners to build ADUs (secondary dwellings) up to 60 square meters – in their backyards without planning permits, with Western Australia also adopting a similar scheme at the start of 2024.

In Victoria alone over 700,000 properties meet the criteria for an ADU without a permit

With Australia facing a national construction shortage affecting housing delivery across sectors, this measure promises to add rapid, cost effective, and extensive new housing stock to the market. By focusing on small, modular units that require minimal labour and expense, ADUs represent a unique opportunity to ease housing pressures.

But one year in, the measure has seen disappointing uptake in Victoria, even though it’s had moderate success in NSW and WA.

Supporting homeowners with superannuation access

To unlock the full potential of ADUs, homeowners across Australia could be allowed to access their superannuation for construction costs. For many, superannuation access could be the deciding factor in building an ADU. Here are some of the key reasons why it should be allowed:

- Immediate income: ADUs could provide an additional income stream now rather than in retirement, with rental returns ranging from $300 to $600 per week, depending on location.

- Financial security: ADUs could act as a safety net by providing an income source in the event of job loss or unexpected expenses.

- Downsizing opportunity: empty nesters could downsize into the ADU and rent out the main house, maintaining their lifestyle and earning income on their property.

- Maximising underused land: many homeowners don’t value their backyards highly and could benefit financially by converting unused space into an income generating units.

The concept of “time preference for money” in behavioural economics also comes into play here: people generally prefer money now over money later.

The superannuation access scheme: why it works for Australia

With superannuation access, ADUs offer a compelling medium-term response to Australia’s housing crisis:

- Minimal draw on superannuation pool: given their relatively low cost, ADUs would require only a minor portion of the total superannuation pool. For example building 400,000 units at $150,000 each would cost $60 billion, just 1.5 per cent of Australia’s $4 trillion superannuation pool. Yet these 400,000 units could meet a third of the national housing accord target of 1.2 million dwellings over the next five years – it might in fact be key to the government meeting that target.

- Reduced pressure on construction industry: most ADUs are prefabricated (built partially or entirely offsite) and therefore these types of homes lessen the strain on the construction workforce and free up resources to deliver more housing.

- Timely housing solution: these units can be built quickly to meet current demand while longer-term housing solutions are developed and implemented.

- Broad potential: in Victoria alone over 700,000 properties meet the criteria for an ADU without a permit. Nationwide, there are likely millions of opportunities for development.

A time-limited rollout such as four years could create urgency and encourage homeowners to decide on whether this measure suits them and is enough time for the industry to scale.

The Downsides

One key downside of this scheme is its broad approach. Not all areas are equally suited to residential intensification, and some regions lack adequate open space and infrastructure to support increased density.

For example at south east of Melbourne, with the highest concentration of jobs outside of the CBD is from that perspective a great place for ADUs, but it is also poorly provisioned for open space.

While many types of infrastructure can be upgraded, creating large open spaces like sports ovals is realistically challenging and expensive in established suburbs. Over time, intensification could strain active spaces—soccer pitches, AFL ovals etc. can only accommodate so many users.

As medium density living typically offers limited to no private yard, intensifying neighbourhoods without adequate recreational areas could pose long-term health challenges, especially given the trends of Australian children becoming increasingly overweight and spending more time indoors. Balancing housing growth with liveable environments is essential for a healthy, thriving community.

According to recent Australian Bureau of statistics projections, Australia’s population could exceed 40 million by the 2050s, likened to a python swallowing a goat whole. There may be no graceful solution to such a rapid increase yet measures like ADUs provide short term relief with some downsides. At the current time in Australia’s urban history, the hope would be that most areas affected by the measure still have sports infrastructure that can be made to work a little harder.

Policy safeguards to protect retirement funds

To safeguard retirement funds, protections could be implemented:

- Covenants on sale: by attaching a restriction to the property title, the value of the ADU could return to the superannuation account if the property is sold.

- Rental income as retirement investment: income from ADUs could be treated as a retirement investment, ensuring financial security in later years.

Beyond rental affordability

While increased rental availability is crucial, the ADU scheme could also impact the broader housing market. If rentals become more affordable, some traditional rental property owners might choose to sell, potentially easing pressure on property prices as well.

A call for federal government action

With superannuation access, ADUs offer a practical, impactful and potentially rapid response to Australia’s housing crisis. Allowing superannuation to fund ADUs would enable Australia to take significant strides toward easing housing pressures and creating more affordable living spaces.

The federal government should act decisively, opening the scheme for a limited time. While not a permanent solution to the housing crisis, this measure could be one of the most effective and transformative tools for Australian housing affordability in the next decade, allowing precious time for long term strategies to take shape. And for just a tiny slice of Australia’s superannuation pool, it could be a bargain for the ages.