The sweet irony is that as the world heads into near certain climate disaster, we have at the same time a crying need for the kinds of investments that could save the planet, or at least make a dent in the prognosis.

That’s the view of climate bonds czar Sean Kidney who was in Australia last week to share some compelling views on the urgency of climate action, but also on the huge potential of his sector to at least avert the worst case scenarios.

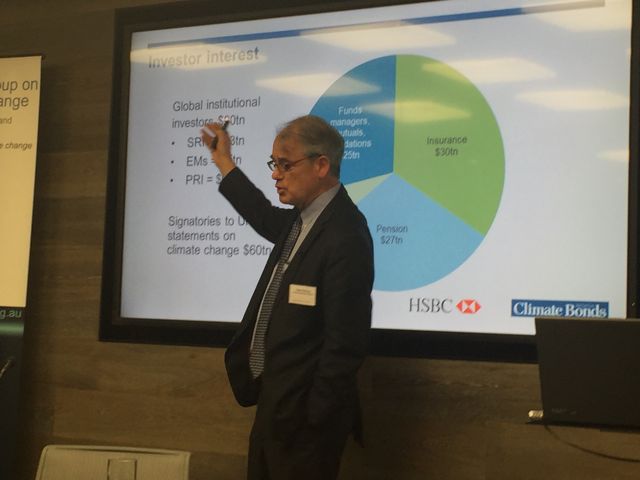

The venue was the Norton Rose Fulbright offices in Sydney and the occasion, last Monday, was the launch of a new report on the state of the sector, the Bonds and Climate Change: The State of the Market in 2016, compiled by HSBC.

- See our report here

Ahead of his presentation Kidney shared some views of the prospects for climate action in the UK after Brexit – will it or will it not turn away from commitment to the climate agenda? Kidney thought not.

“What I’m hearing out of Treasury,” he told The Fifth Estate, “is they’re desperately looking for a way to reposition the UK in terms of exports and finance and they’re seizing on green finance as a way to promote London, so my hunch is that Brexit is not particularly detrimental to the areas we’re looking at.”

Of course a downturn in the economy could mean a renewed reliance on oil and gas, he said.

“On the other hand if the economy goes down so do emissions.”

Globally the intentions to decarbonise were growing powerfully, he said, with a caveat that new scientific forecasts were even more grim than expected.

“We are seeing a sea change. I hope it’s not too late. We’re seeing India with extraordinary ambitions around green investment – extraordinary ambitions – which should be enough to send a cold chill down the spine of any coal investor in Australia. I can tell you that now.

“China is already telling people to close down coal power stations. If you’re invested in coal it’s time to get really worried.

“Are we doing enough on climate? The supertanker of China is moving really quickly to go green, but it’s got a long way to go.

“I’m always torn. According to the scientists it’s game over. The scene is incredibly bloody chilling. It’s unnerving. We have a few short years at best to turn the supertanker around.”

On the other hand, the conversation had “shifted dramatically” since Paris.

During his address Kidney ranged across the impact and displacement of huge populations due to climate change, much in powder keg regions of the world in Asia.

We’re on track to loose the West Antarctic shelf, which would mean six to seven metres of sea level rise and sea levels are already up by 0.8 metres.

We are “dicing with our kids future”, he said.

“I’m not trying to say it’s definite; it’s a 50 per cent or more probability. If you told me you had 50 per cent probability to have a car accident you wouldn’t get in the car. Actuaries are realising how chilling the science is.”

The good news is that infrastructure can be overwhelmingly green – rail, clean energy, water.

“We don’t need a carbon price to do it. We know how to do it; we’ve been building infrastructure for 150 years.” Just the kind of deals that Macquarie Bank might like to finance, he said.

There were a bunch of tools we can use.

“When you look at what we can do for climate change it’s incredible how much is investible.”

And there is plenty of money about to do what we need to do.

What’s frightening, he said, was how much zero interest was around. Japanese bonds have negative interest. So it’s not hard to beat that as an attractive investment.

“How are we going to pay our pension funds? It ain’t going to be possible; they need yield.”

The great piece of good luck is that this represents a brilliant opportunity for green climate-focused investment.

“What we can do with the right kind of pact with government…”

We could create a class of investment that pays a good yield and also propels economic growth – and is climate friendly.

Globally India is looking at growth of “7-8-9 per cent”.

“In India between now and 20130 the bulk of the built environment will be rebuilt,” he said.

“This is not niche. This is a big chunk of the economy going forward.”

You bet infrastructure can be regenerative (beyond green). ISCA is leading the way there with the take up of the IS rating scheme. However the risk from inaction on climate change remains horrendous and will only get worse. Join me on 2 August at UTS for The Big Conversation with Ian DUNLOP. In the UTS Great Halk at 5:30pm for 6:00 star. We will be addressing the risks on inaction.

Thanks David and thanks for asking me to be part of the panel! Very excited to participate. Sign up all! Ian Dunlop never disappoints and what the engineers do and say is highly influential in our patch.