Investing in environmental sustainability brings a sizeable pay-off in the form of health and human well-being. You’ll have heard that one before, of course, but what of the “health and well-being” of your bank balance?

It turns out sustainability has a fiscal dividend, too, one that’s weighing on the minds of NSW voters with a decision to make later this month. Sky high energy prices, and floated solutions which dovetail nicely with the drive for net zero, are shaping as key state election issues this year.

Rarely has our dependence on fossil fuels been as costly for ordinary Australians as it’s been since Russia’s invasion of Ukraine.

A resulting international shortage drove the price of coal and gas through the roof, with energy regulators forced last July to raise the cap on electricity charges in NSW by anything from 9.6 to 18.3 per cent, and gas retailers such as AGL passing on NSW price increases of $78 a year (9 per cent) last month.

The sense of helplessness consumers felt during the oil embargo of the early 1970s has been replaced, for many of us, by anger at politicians, wholesalers and retailers this time around.

Gas corporations are clearly war profiteering from the crisis in Ukraine, and unlike in the ‘70s, it’s now common knowledge that there are renewable energy sources, which our elected representatives – many of them pocketing generous donations from the fossil fuel industry – haven’t switched to quickly enough.

You could be forgiven for thinking otherwise with an election approaching, and state politicians from both major parties clambering over each other to show voters they’re the ones with a firmer grip on the fact that switching to renewable energy will permanently drive down bills.

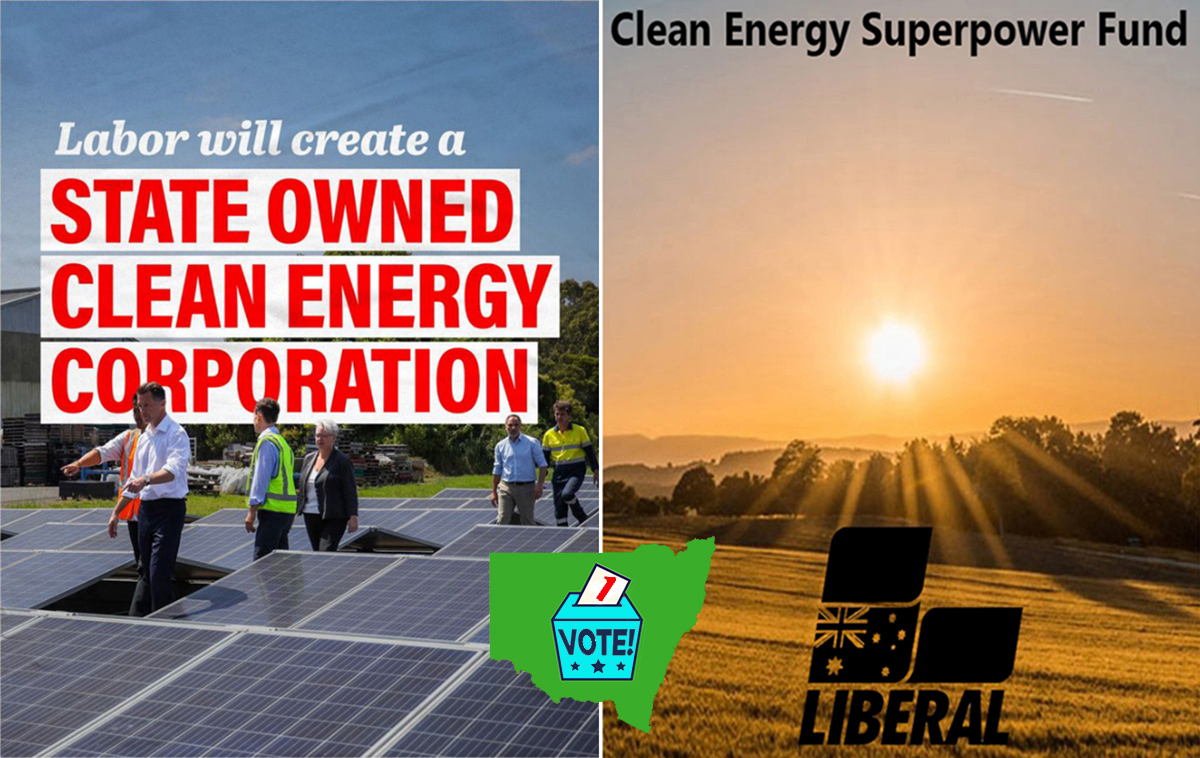

Both the coalition government and Labor opposition want to throw billions at the transition, via snazzy-sounding mechanisms like the Clean Energy Superpower Fund.

With a deluge of pre-election promises and propaganda descending on households across NSW, The Fifth Estate poses the essential questions: who’s offering the more effective solutions; and “are there any alternative approaches” (as politicians like to ask) which might further expedite a transformation which – for both our planet and our hip pockets – can’t come quickly enough.

Switching wholly to renewable energy will permanently drive down power bills and get us to net-zero carbon emissions. It’s the definitive “win-win” scenario, but we’re not there yet, so what’s the quickest, most effective way of getting there?

Capping prices, or offering rebates to folks who shop around for the best energy plan, might offer short term insulation from angry voters, but NSW politicians have long since concluded that for longer-term electoral relief, they must more seriously address our fossil fuel addiction (at least at the level of domestic consumption).

Cue the closely-choreographed announcements, one late February weekend, of duelling, billion-dollar clean energy plans.

First up on the Saturday was Treasurer and Minister for Energy Matt Kean, who promised $300 million in grants to incentivise storage and grid reliability projects – including big batteries and pumped hydro, which private investors sometimes shy away from.

This comes on top of $1.2 billion already earmarked for high-voltage transmission lines linking solar and wind farms to the grid (the Transmission Acceleration Fund, or TAF) infrastructure deemed vital to fast-tracking the replacement of fossil fuel power stations.

The very next day, Labor leader Chris Minns saw Kean’s $1.2 billion TAF and raised him a further $1 billion for a state-owned energy security corporation to drive investment in community batteries, together with those same storage and grid stability projects which private investors often see as risky.

That’s a grand total of $2.2 billion, with Minns’ proposed NSW Energy Security Corporation (ESC) distributing $1 billion in grants (sometimes as a partner with private capital) more than three times the $300 million in allocations pledged by the current government.

Labor’s $700 million more, for infrastructure deemed critical by both sides, is seen as a big difference by the Smart Energy Council’s political strategist Wayne Smith.

“What their announcement does is to specifically focus on storage, and that’s still the missing piece of the puzzle when the sun doesn’t shine or the wind doesn’t blow,” Smith told The Guardian.

The very catchphrase used to sell Minns’ plan – “Labor will create a state-owned Clean Energy Corporation” – conjures up the spectre of socialist-style command-and-control, with the potential to scare away private capital.

When the general idea was first floated late last year, a Labor source told The Australian that if the private sector failed to act quickly on this “risky” but vital infrastructure, the state-owned corporation could intervene.

However, the ESC unveiled by Minns last month seems intended as a non-interventionist body more closely resembling the federal government’s Clean Energy Finance Corporation (CEFC).

Labor “appears to have struck the right balance…to ensure the state remains a beneficiary for private investors,” Clean Energy Council chief executive Kane Thornton said.

Kean seized on Minns admission his plan could take up to seven years to achieve lower prices, but the Labor leader insisted that stopping the further privatisation of distributors Ausgrid, Essential Energy and Endeavour Energy was the best way to keep a handle on bills.

“We think prices [would] just go up further and further and further [if] you put it into the hands of a private company,” Minns told AAP.

The Minns ESC proposal may have given Labor a rhetorical cudgel against what it calls the LNP’s “privatisation-fuelled energy crisis,” but will it have any real impact?

Labor seems to be on a winner with its attacks on privatisation. Polls show that soaring prices and the general cost of living are leading issues for NSW voters; his ESC proposal gives Minns a narrative edge on high utility bills, with privatisation widely blamed for that.

The Minns ESC proposal may have given Labor a rhetorical cudgel against what it calls the LNP’s “privatisation-fuelled energy crisis,” but will it have any real impact? ESC “partnerships” with capital on certain projects would affect only a small slice of the state’s clean energy framework.

Compare this to Victoria, where the Andrews government is moving to revive a publicly-controlled State Electricity Commission (SEC) which would play a much bigger role in allocating the same amount Minns pledged – $1 billion – on the same kind of projects.

Solar farms, wind farms and other clean energy infrastructure would remain under the effective control of private operators with the potential for price gouging and prioritising shareholder interests over the wider wellbeing.

Government would have a belated “seat at the table,” but if the history of successive NSW governments kowtowing to developers and the pokies lobby is any guide, that seat could be at the kiddies’ table.

Compare this to Victoria, where the Andrews government is moving to revive a publicly controlled State Electricity Commission (SEC) which would play a much bigger role in allocating the same amount Minns pledged – $1 billion – on the same kind of projects.

The SEC will majority-own its renewable energy assets: in stark contrast with Minns’ ESC, which would primarily hand out a bunch of grants.

Governments can’t be relied upon not to interfere with government businesses, meaning private investors will be reluctant to invest

“The Victorian government is giving its clearest indication yet that the transition to renewables will be properly planned – in a way that will look after workers and will keep Victoria’s lights on,” Premier Daniel Andrews said.

The new SEC will “consider all options,” including becoming a state-run retailer or partnering with one that’s pledged to an “ethical” business model.

Clearly, Victoria’s government wants the SEC to play a central role, but is it the way to go?

Power purchase agreements

Marion Terrill from the Grattan Institute told The AFR the Victorian policy was “very unwise,” because governments can’t be relied upon not to interfere with government businesses, meaning private investors will be reluctant to invest.

“Unless the government’s going to provide a power purchase agreement that makes those economics work, it’s going to be very difficult for the Victorian government to use it as a tool to lower power prices,” Atlas Arteria CEO Graeme Bevans added.

Power purchase agreements – between a majority SEC-controlled wholesaler and retailers, or large property companies (“off-takers”) – may yet emerge as the answer to this quandary, but you can be assured they’ll prohibit flagrant profiteering.

To allow price gouging of the kind we’ve seen since privatisation would be electoral suicide for the SEC’s “parent company,” the Victorian Government.

Price gougers are on notice. The views of free market pundits notwithstanding, Victorians may well wind up enjoying lower prices and decision-making in everyone’s best interests.

Lower retail prices aside, the point of switching to clean energy, in case you’ve forgotten, is net-zero emissions, pursuant to the Paris Agreement.

It looks like humanity won’t be adhering to that agreement, but we’ve signed on to do our bit regardless.

To achieve net-zero as soon as we can, governments must find the best way to establish, connect and ensure reliability for Renewable Energy Zones, our modern-day power stations.

The culture wars of gas

There are also objectives on the demand side of energy that governments, businesses and suburban families aren’t taking seriously enough: energy efficiency in commercial properties and homes; monitoring to achieve that; heat pump efficiency and incentives for that latest front in the culture wars, the switch from gas to electricity.

“There are significant gains to be made on the demand side. High energy prices are one thing, but your bills can be relatively low if you cut out the waste,” Tony Westmore, general manager of the Australian Alliance for Energy Productivity, told The Fifth Estate.

It’s not just the power bills, it’s the planet. They go hand in hand.